CALL US TODAY - 205-422-4255

EPAct 179D and 45L Energy Tax Incentives

The 179D & 45L Have Been Enhanced and Extended

The Energy Policy Act of 2005 (EPAct) was enacted creating immediate potential savings for building owners or architects and engineers based on the use of energy efficient improvements. Section 179D outlines the requirements for a maximum potential tax deduction between $2.50 and $5.00 per square foot of affected spaces. The recent Inflation Reduction Act also prompted the following allowances:

- Deduction Levels up to $5.00 Per square foot - the qualified range for projects meeting prevailing wage and apprenticeship standards will be between $2.50 and $5.00 per square foot, depending on the building's energy efficiency level. For projects that do not meet the prevailing wage and apprenticeship standards, the deduction level range will be between $0.50 and $1.00 per square foot.

- Inclusion of non-for-profits, instrumentalities and Tribal Government buildings - Designers of energy systems in these buildings are now allowed to claim the 179D deduction for qualifying projects.

- Deduction reset - currently, the maximum 179D deduction can be taken once over the life of the building. With the passage of this Act, the maximum deduction would now be available every three years on a commercial building and every four years on a government, instrumentality, not-for-profit, or Tribal Government building.

The Section 179D Commercial energy incentive was previously made permanent. Though these new changes have significantly increased the deduction per square foot from the current maximum of $1.80 SF in 2022 to upwards of $5.00 SF in 2023 and beyond. This change is intended is to reward the developers who design and build energy-efficient commercial buildings.

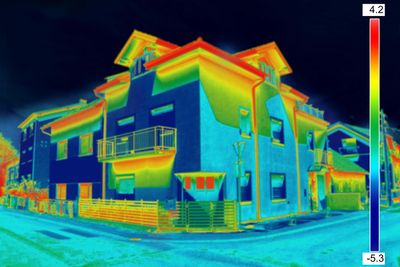

This applies to the 3 building subsystems: 1) Building envelope, 2) HVAC/Hot water systems, and 3) Lighting and lighting controls.

This includes multifamily buildings that are four stories or more above grade. Both new Energy-efficient construction and energy efficient retrofit/conversions of existing buildings are eligible.

Tax-exempt entities that develop/own energy efficient buildings can allocate 179D tax deductions to architects, engineers, and designers responsible for designing the energy efficient systems. Before these changes, only allowed for government owned buildings to allocate these tax deductions to their designers.

45L Tax Credit Has Been Extended for 2022 and Expanded with Increased Benefits in Future Years.

This highly coveted residential tax credit had expired on 12/31/2021. However, the 45L residential tax credits have been retroactively extended for 2022 and remain unchanged from the previous 2021 guidelines. This offers significant benefits for multifamily developers and homebuilders of $2,000 per qualified dwelling unit.

For example, a three (3) level or below apartment development of 300 units that goes in-service in 2022 can qualify for up to $600,000 in tax credits

Then, beginning 1/1/2023 for units put “in-service”, the allowable maximum tax credit increases to $5,000 per dwelling unit for both single-family and multifamily developments. To achieve this high mark, the energy efficiency criteria must align with Department of Energy program for Energy Star and Zero energy ready homes.

Additionally starting 1/1/2023 all residential developments can become eligible, when before only low-rise residential developments were eligible.

However, maximizing the energy efficiency tax credit to the $5,000 per qualified dwelling unit can require that construction wages on the specific project be paid at/above local prevailing rate as determined by the Secretary of Labor.

With the Inflation Reduction Act and its green initiatives, it seems Congress has decided to address climate change through the commercial real estate industry by expanding energy efficiency tax incentives.

While not all provisions in this legislation may be a welcome change, these two energy efficient building components are very good for real estate developers and designers.

UFS will review your project on a Complimentary Basis. Projects between1/1/06 - Present are eligible. For new construction, we typically look for the Architectural, Mechanical, Electrical, and Plumbing drawing sets in .pdf. For retrofits, we look for information on the project like projects cost, spec sheets, energy saving estimates, as well as the project address and any drawings (New or Pre-existing). Upon completion of our complimentary review, we will estimate your project's tax deduction as well as provide you with a fixed fee quote for your project.

Research and Development Tax Credits

Introduction

Since its adoption in 1981, the R&D (formally, the Research & Experimentation) Tax Credit has been one of the most significant resources used by companies, in a wide range of different industries, to maximize their bottom line. Initially designed to promote domestic innovation and R&D investment, the credit has evolved constantly during its lifetime. According to the advocacy group, the R&D Credit Coalition, only 17,700 public and private companies have claimed this dollar-for-dollar credit totaling $6.6 billion dollars. The large majority (over 65%), of eligible companies overlook or fail to take full advantage of this tremendous opportunity.

Benefits

The Research and Development (R&D) Tax Credit is one of the most substantial incentives under current U.S. tax law because, unlike a standard deduction, it is a dollar-for-dollar credit against your tax liability. Depending on your company’s qualified research expenses, the credit can include eligible wages, supplies, and outside contractor expenses. Also, this federal tax incentive is available in over 30 states. Lastly, the R&D Tax Credit is available for all open tax returns, which usually includes up to 3 previous years and the current tax year. In the case of insufficient lax liability, firms may have the option to carry the credit forward 20 years.

Qualifications

The common misconception about the Research and Development (R&D) Tax Credit is solely for traditional white lab-coat activities and manufacturers. Recent legislation has broadened the industries and companies that qualify for the credit. Common R&D eligible activities include:

- Pre-production design & engineering of a new product or improved existing product

- New process or production improvements

- Prototyping and patent applications

- Experimenting or testing new concepts, formulations, materials, tools, and procedures

- Software development for internal use or sale

- General trial and error experimentation

The essential criteria for Qualified Research Expenses are summarized in the Four-Part Test: Elimination of Uncertainty

- Expenditures represent research and development costs in the experimental or laboratory sense if they are for activities intended to discover information that would eliminate uncertainty concerning the development or improvement of a product.

- Uncertainty exists if the information available to the taxpayer does not establish the capability or method for developing or improving the product or the appropriate design of the product.

- In order to satisfy the technological in nature requirement for qualified research, the process of experimentation used to discover information must fundamentally rely on principles or existing technologies of the physical or biological sciences, engineering, or computer science.

- There is no “discovery” requirement, which abandons the requirement that the research activities be undertaken to obtain knowledge that exceeds, expands or refines the common knowledge of skilled professionals in a particular field of science or engineering.

- The taxpayer must intend to apply the information being discovered to develop a new or improved business component of the taxpayer.

- A business component is any product, process, computer software, technique, formula, or invention, which is to be held for sale, lease, or used in a trade or business of the taxpayer.

- A taxpayer must be able to tie the research it is claiming for the credit to the relevant business component.

- A process of experimentation is a process designed to evaluate one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain as of the beginning of the taxpayer’s research activities.

PATH Act Changes for Small Business starting in 2016

Companies who may not have qualified in the past can now benefit from R & D tax credits. These resent changes are great for both small and mid-size companies; life sciences, biotech, food science, bio-flavoring breweries/distilleries, aerospace, industrial automation and controls, architectural firms and engineering design, software & web development, and more. The PATH Act changes even allow for pre-revenue "start-up" firms to offset their FICA tax liability with this R & D tax credit.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.